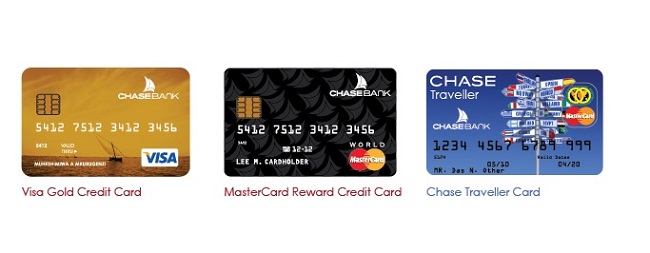

Chase Bank Visa Gold Credit Card

Credit Cards

About this product

This is a credit card from chase bank

Features

- Loyalty points with every point of sale purchase, 1 point for every KES 500

- A cash advance up to your credit limit

- A payment plan of 10% as the minimum amount you need to pay

- Up to 50 days interest-free period

- Insurance cover currently being negotiated that will include travel insurance, purchase protection, ATM hijack/ robbery, fraudulent charges

Bank Network

- Chase bank has a wide network of branches and ATM's across major towns, with over 40 branches in the country

- Chase offers Agency banking is available to its Customers, where they can deposit, withdraw or even do other transaction safely and at conveniences.

Online/ Mobile banking

Online and mobile banking is available to the account holders. To access online banking the customer has to download the Mfukoni app and select online banking to create an account to use for online banking, while Mobile banking can be accessed by:- dialing USSD Code *275#

- downloading the Mfukoni bank mobile App.

Tariff Guide

- For more information on the chase bank tariff guide, click here→

Fee OverView

| Joining Fees | Waived |

| Annual Fees | Waived for 2015 |

| Late Payment Fees | KES 1,000 per month |

| Over Limit Fees | KES 1,000 per limit excess |

| Cash Advance Fees | 6% of the total amount withdrawn |

| Supplementary Card Fees | KES 2,000 per card |

| Monthly Interest Rate | 3% |

| Card Replacement Fees | KES 1,000 per card |

Comments